Investor finance is different.

Property investing isn’t just about finding the right property — it’s about having the right mindset, metrics, and money structure to support long-term growth.

In our Investor Guide, you’ll explore the Three M’s of Smart Property Investing:

🧠 Mindset – Build the discipline and focus to navigate challenges and grow your portfolio.

📊 Metrics – Learn the key numbers to track performance and make confident decisions.

💰 Money – Understand how to structure your loans and manage cashflow so your money works harder for you.

Whether you’re buying your first investment property or expanding an existing portfolio, this guide will help you ask the right questions and take your next step with confidence.

Step-by-step guide to buying an investment property

Step 1: Decide your goals

Are you looking for yield or capital growth from your investment property.

Capital growth is the amount a property increases in value over time, while yield is the 'return' you receive on a property investment, most commonly in the form of rent.

Generally, high-growth properties are often more expensive and negatively geared, and high-yield properties are more affordable and positively geared.

So do you want a property that generates a high income and is profitable from day one? Or are you comfortable funding a shortfall every month, with a long-term goal of paying down the debt while the property increases in value?

If you haven’t already download a copy of the 3’m’s of investing. In this guide you will learn how to:

Develop a mindset to think like an investor

Understand the maths involved in investing

Understand the nuances of finance, managing your cash flow and how important it is to work with your accountant, especially around negative gearing.

Step 2: Equity or Deposit?

How will you fund your deposit for your potential investment property purchase? Do you have savings in cash, shares you can sell or will you use equity in your existing home?

Equity is the difference between the current value of your property and the amount you owe on your home loan. Most lenders will let you access up to 80% of your property value (this can vary between institutions).

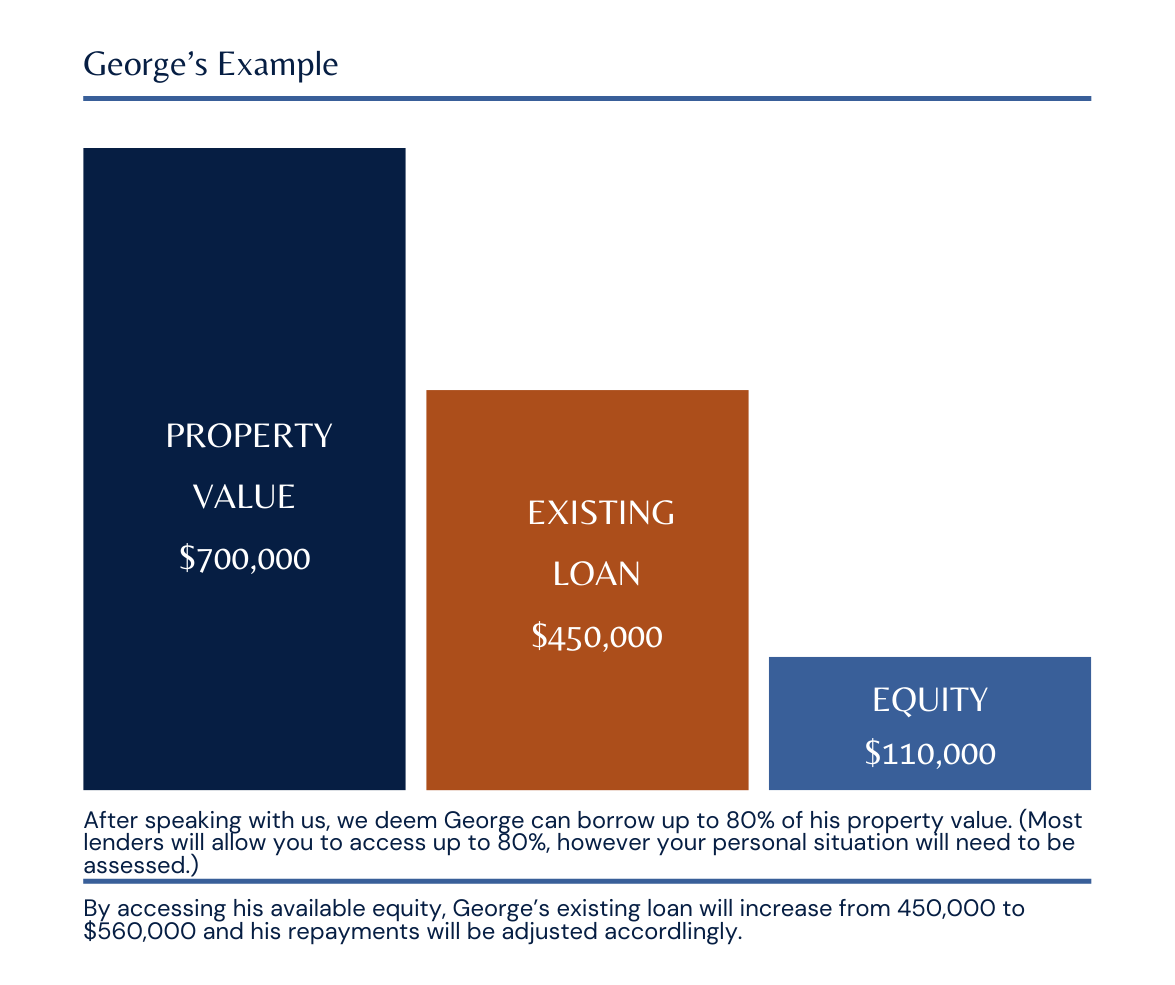

Example: George’s property is currently valued at $700,000 and he has an existing home loan owing $450,000.

After speaking to us, we determine George has $110,000 in available equity to use as a deposit. (This is calculated as ($700,000*80% -450,000 = $110,000.)

Step 3: Determine your borrowing power.

Your borrowing power is determined by your income less expenses and liabilities and is required to be done on an individual basis. For investment properties, we can use rental income, or projected rental income via a rental appraisal.

After collecting your relevant personal information, we can make an informed assessment of what bank’s would be willing to lend. This will also allow us to asses any positive or negative cash flow from the proposed investment property as well as give you a recommendation for what type of loan might be suitable.

Different types of investment loans can help you achieve different results. We have accessible to wide range of lenders and options such as fixed and variable interest rates, access to offset accounts and redraw, and interest-only payment periods.

Consider which features are important to you, so you can tailor your investment loan to suit.

Step 4: Do your property homework

After knowing where you stand financially and how you will fund the deposit, you will then have an idea of what property purchase prices you can look at.

You can then begin the search for a property which fits within your budget and will achieve your financial goals.

We can help with property and suburb reports to obtain the vital metrics you need to make a good decision on where you should buy.

Step 5: Obtain Preapproval

It’s not an essential step, but it can help you in the marketplace make a more appealing offer.

Step 6: Secure your property

Now is your chance to make that offer on a property. With previous experience as a real estate agent, we are in a position to guide you on any part of the process you are unsure of.

Step 7: Settle and manage your investment property

Settlement proceeds the same as it would when buying your own home, except you don’t collect the keys and move in. Instead, you engage a property manager and begin finding a new tenant, or take over the lease agreement with the existing tenant.

With an experienced property manager and relevant insurance in place, your investment property journey continues.

We're here to help

Download our guide to Investing - the three M’s of Investing. Once you’re a landlord, working with a property manager can help you manage tenants and your property going forward.